Prepare For A Great Retirement

And Enjoy A Better Life Now And In The Future

Massey Financial Advice uses Practical Financial Modelling to help busy professionals see the future results of your current decisions so you can enjoy a better life now and in the future

If You Keep Doing What You’re Doing,

Where Will You End Up?

Do you ever worry about your retirement – if you’ll have enough money, how you’ll afford the lifestyle you want, what sacrifices you’ll be forced to make when you stop working?

You’re not alone. Most people secretly worry about their future. And with good reason. Because according to the Pension Review Background Paper 2008, 77 per cent of Australians over the age of 65 receive income support.

Yes, many struggle to live on just $34,300 for a couple or $22,700 for a single.

It’s no wonder so many Aussies end up in financial hardship. But it doesn’t have to be this way.

Are you Certain

you won’t run out of money and have to:

- Sell the family home

- Move miles away

- Live with kids

- Put up with debilitating health problems

- Forget about travel and other bucket list activities

- Be totally constrained by money (all the time)

- Have no money to spoil grand kids

- Be at the mercy of the government

How Massey Financial Advice Helps You

Massey Financial Advice has developed a proven process to help you grow your future wealth while maintaining balance with your current lifestyle.

The team at Massey take time to talk to you about your challenges and get an understanding of your unique circumstances before creating specifc strategies to give you the outcomes you want. And not just theory — we work with you step-by-step to help you implement a practical plan that brings real results.

How the Massey Process Works

Massey’s unique Financial Modelling Process is like looking at your future in a crystal ball. It shows how today’s decisions affect tomorrow’s outcomes.

For instance, you may wonder how investing extra in private education for your children will affect your retirement income. By analysing your unique situation our modelling software will give you the answer.

How about an extension to your house, upgrade of your car, or overseas holiday? We can give you a financial snapshot to help you weigh up these decisions.

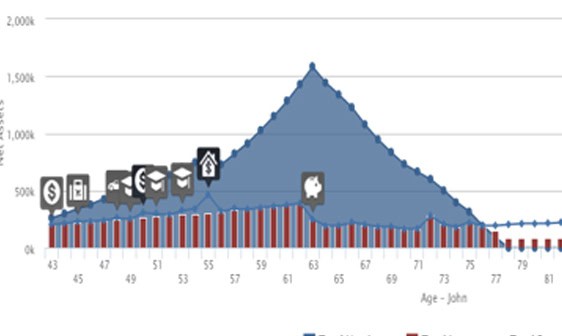

They are currently aged 43 and 41 respectively, plan to work until age 63, and according to Australian averages they can expect to live until 82 and 86.

The blue shaded area to the left of the peak shows how they are building assets while they are working. The icons and rising expenditure line show various expenses during this time which include…

- Overseas holidays every 3 years

- Replacement car every 5 years

- Private high school fees for 3 children from John’s age 49

- Purchasing a boat at age 50

- Home renovations at age 55

The spot where the blue net assets line meets the horizontal axis indicates when John and Sue will run out of money (around age 78). This gives them the opportunity to adjust their planning to achieve a different outcome. For example they could…

- Reduce their expenditure by changing or postponing some goals

- Become more disciplined with their spending (now and in the future)

- Modify their savings levels

- Adjust their investment risk

With this information, John and Sue can make decisions that help them prepare for retirement, balanced with current spending and life experiences.

Imagine having this financial modelling for your income, expenditure, and assets. Like John and Sue, it would help you to see how your current decisions will affect your future finances (and potential lifestyle).

This is just part of the process we use to help you plan for your future, adjust for changing circumstances, and stay on track to getting the outcomes you want. And it’s a key part of our ongoing service at our goal progress meetings.

Note: This case study is illustrative only and is not an estimate of the investment returns you will receive or fees and costs you will incur

We Make Advice as Easy as

1

Claim your FREE 25 minute call with an experienced Financial Adviser

2

We find out about you and put together strategies to help you, making sure you understand them

3

We prepare the paperwork to help you implement any changes and check in to ensure your success

About Adam Massey

Adam Massey, founder of Massey Financial Advice, is a Certified Financial Planner® with a Bachelor of Business and a Diploma of Financial Planning. He is married to Bron, they have 3 children and Adam has lived in Sydney, Adelaide, Canberra, Port Douglas, London and now Brisbane. He was an active committee member of The Mater Foundation and volunteers at the school tuckshop. In other words, he has more than textbook knowledge – he has the formal training and life experience to help you get the financial outcomes you want – to build wealth for retirement without sacrificing your current lifestyle.

Fee Structure

Many financial planners are affiliated with a large organisation and base their fees on the amount of money you have to invest, taking a percentage based fee. We prefer to operate an affordable Fee-For-Service model based on providing value to you.

That way you can be sure our advice always has your best interest at heart.

Graduate

Australian Institute of Company Directors

What Others Are Saying…

Here is a small sample of what other people say about their experience dealing with Adam.

How to Explore Working Together

Would you like to know exactly how much money you’ll have when you retire based on your current plan? Would you like to know how to fast-track this plan so you can retire earlier and with more money? Would you like to know how an upcoming decision will affect this plan?